|

Written by TAYLOR BRYANT

Remember back in November when we reported on Nail Inc.'s new spray-on nail polish and our entire office, along with the rest of the internet, proceeded to lose its freaking mind? Well, we didn't think it was possible, but Milk Makeup is now taking the craze to even wilder extremes with spray-on nail art. Oh, snap. The edgy new makeup brand, launched by Milk Studios, is releasing its own version of spray-can polish, along with a collection of nail stencils to help you create intricate designs, cool ombré effects, and even a French manicure (don't laugh, it's making a serious comeback), all with the aim of a nozzle and the press of a button. The nail design renaissance is showing no signs of slowing down, which is why it makes perfect sense to speed the polishing process up. Milk Makeup is the self-professed friend of the "on-the-go" gal, and nothing says "get out the door" faster than an artsy manicure that you can apply in seconds. We got our hands on a bottle before it hit the market, and are happy to report that it follows Milk's ethos. The pigment applies easily without any streaks or bubbles — something that has plagued even the most meticulous polisher. What's more is that it dries super fast and the excess pigment around your nails washes off easily with soap and water. (Full disclosure: you may need a Q-tip with some nail polish remover to get off some of the color that's super close to your nails.) Fun to use and basically fool-proof? We're sold. The polish, priced at $12, is available for pre-sale today on Urban Outfitters. Until you can get your hands on a bottle, we suggest checking out the video below to tide you over.

3 Comments

Written by ERIN CUNNINGHAM We're calling it now: The "Leonardo DiCaprio effect" is officially a thing. On the heels of the 41-year-old actor's first Academy Award win, one item has gone viral and sold out completely — and we're not talking about Trefoils Girl Scout cookies. In September, Vetements (a Kanye West favorite), known for its sartorial rule-breaking, showed a variation of its now-insanely-popular, super-long-sleeved sweatshirt with an image of young Leo and Kate from Titanic screen-printed on it. At the time, a nod to the '97 blockbuster may have seemed random. But, now that DiCaprio is making headlines (and rightfully so), the terry cloth hoodie seems like it hit shelves at just the right time. Despite its $885 price tag, the item has sold out completely across the internet (on sites like SSENSE, MatchesFashion, La Garçonne, Dover Street Market, Antonioli, and Selfridges), and we're thinking his win has a little something to do with it. Though we haven't received official confirmation that this was the reason behind things (we'll update this spot when we do hear back), but we're betting the odds are likely. (Remember: The lengths fangirls will go to knows no bounds.)

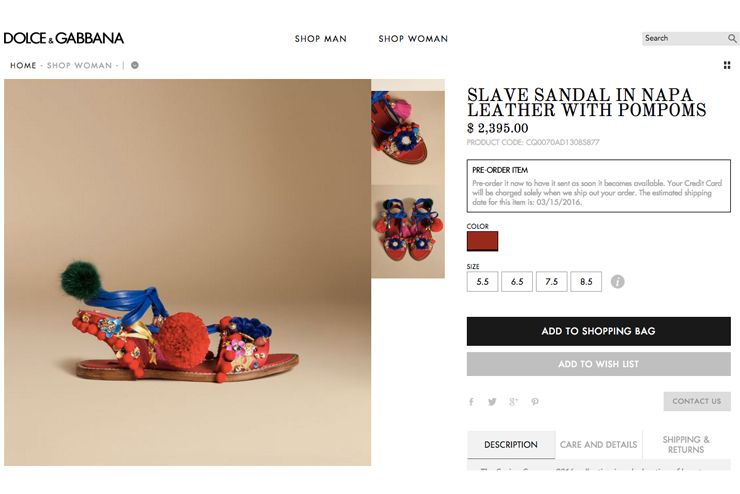

If you're a die-hard DiCaprio fan hoping to get your hands on this Demna Gvasalia-designed piece, the slightly cheaper, hooded T-shirt version is still available on SSENSE in every size except large — though we're betting that stock won't be around for long. And for those who cannot. live. without. a sweatshirt emblazoned with Leo's young mug, there are a few overpriced options up for auction on eBay. One bit of advice: Once you get your hands on this inevitable collector's item, never let go. Written by ANA COLON Dolce & Gabbana has been mired in more than its fair share of controversy — yet it's still a bit surprising, and certainly disappointing, when this type of thing happens yet again. The Italian fashion house's latest misstep: a pair of pom-pom accented leather shoes available on its website dubbed the "slave sandal." The four-figure footwear is a part of Dolce & Gabbana's spring '16 tourist-inspired collection, and the shoe's name has since been changed to "Decorative Flat Sandal." (You can see a screenshot of its cringe-y original classification here and below.) In the item's description, the sandals in question are called "Bianca flat sandals" — no mention of "slave." The same style is also available for pre-order at Moda Operandi and Saks Fifth Avenue, but neither retailer uses the word "slave" to describe the pair. Footwear Newsreports that the term is an outdated descriptor for a lace-up sandal silhouette, now more commonly referred to as gladiator. We have reached out to Dolce & Gabbana for comment, and will update this story when we hear back. The spring '16 collection, Dolce & Gabbana's site reads, is a "declaration of love to Italy, told through unique clothing and accessories on an imaginary journey through the wonders of this country." Domenico Dolce and Stefano Gabbana's ode to Sicily (where Dolce is from) for spring '13 was also quite contentious: The brand sent a pair of "blackamoor" earrings down the runway — a decision that the designers went on to defend despite public complaint. There was a similar situation on the newsstand in 2011: Vogue Italia ran an editorial featuring oversized golden hoops it described as "slave earrings." The publication's editor-in-chief, Franca Sozzani, later apologized, citing mistranslation.

Dolce & Gabbana has made a few relatively progressive moves over the past few months, following a series of missteps in the last couple of years (including the blackamoor earrings and the designers' very poorly received comments on same-sex couples having children through adoption and IVF). In January, the brand revealed its first collection of hijabs and abayas. Shortly after, Gabbana teased a capsule collection with the hashtag #DGFamily, depicting same-sex couples and their children on handbags and T-shirts. As innocuous as the erstwhile name of a pair of sandals might seem, it's a stumble that, unfortunately, detracts from the sligthly more positive inroads D&G has made recently.  In April, Elle writer Justine Harman spotted a classic, nylon box-shaped Kate Spade bag on eBay. The bag, she noted, was knocked down from its original price of $250 to a staggeringly low $39.99. (That particular discounted bag has now been sold, but remaining "vintage" Kate Spade items are still marked down pretty low.) While this discovery delighted some millennial women who grew up begging their parents for one of these handbags, others might have noticed that this dramatic price dip is indicative of something bigger: The designer handbag industry is losing its luster. As with all trends, there's an ebb and flow. Not everything can stay relevant forever. Kate Spade has adjusted to a more colorful, bright, fun look, but the company's offshoots, Kate Spade Saturday, targeted towards millennials, and Jack Spade, which tapped into the men's industry, shuttered all their doors in the winter, The Wall Street Journal reported. In April, Bloomberg noted that Michael Kors was the top handbag for teens, replacing Coach. Kate Spade was in third place. But Michael Kors' sales growth has been eroding, and prospects do not look good for the brand. The brand's inventory has risen, suggesting that the brand's products aren't flying off shelves. FacebookMichael Kors rose to popularity because of its handbags. It might be because the brand is too popular — or too widely purchased. This is in part due to the presence of outlets — which Michael Kors has aplenty — which can ultimately be brand killers. Outlets devalue a brand, encourage people to not buy at full price, and make luxury items too accessible. Further, widespread popularity is the "kiss of death for trendy fashion brands, particularly those positioned in the up-market younger consumer sectors," industry expert Robin Lewis wrote on his blog. Lewis compares Michael Kors to Tommy Hilfiger, which reached its peak in the late 1990s. Michael Kors is considered an aspirational brand, with consumers paying a premium for its label. Once everyone has the product, it is no longer considered cool. Other brands that have experienced this phenomenon include Juicy Couture, Jordache, and Coach — which Michael Kors dethroned as the most popular high-end handbag brands for teens, as Bloomberg has reported. But Coach's woes are undeniable. CNBC reported the bizarre disparity for Coach: Sales still dipped amid shares rising. On a recent earnings call, CEO Victor Luis attributed this to how the brand has been cutting back on flash sales. Sweeping up shoe brand Stuart Weitzman at least helped slightly; "the acquisition of Stuart Weitzman in early May contributed $43 million to fourth-quarter and full-year revenue," CFO Jane Hamilton Nielsen said on the call. But it might not just be handbags that are at a loss. This pattern is indicative of a much larger trend. After all, millennials spend their money differently than the generations preceding them did. Old-school retailers like Gap have suffered compared to fast-fashion companies like Zara and H&M, which allure millennials with their quick turnaround and low-price. Traditional retail has been struggling as a result. And those traditional retailers who attempt to cater to millennials instead of baby boomers or Gen Xers face huge possible risks: Millennials don't spend that much money as it is. Saddled with debt, this generation isn't spending money on luxury items. And by alienating consumers who do have money, retailers inadvertently put themselves in a precarious situation. Who will buy from them? Hilary Stout illustrated this problem in The New York Times in June: "After all, the millennial generation has less wealth and more debt than other generations did at the same age, thanks to student loans and the lingering effects of the deep recession," she wrote. And Forrester researchers highlighted in a study that baby boomers, between the ages of 51 and 69, are the "biggest spenders" because they have extra cash from decades of saving and investing — something millennials just can't afford. Additionally, millennials are flat out not spending on apparel. A study by Morgan Stanley highlighted that millennials are instead choosing to spend money on expenses like rent, cellphones, and services. Macy's CFO, Karen Hoguet, even blamed Netflix on the sales slumps. "I think part of that is the customers are buying other things, whether the electronics, cable services, Netflix, whatever," Hoguet said.

Ultimately, there's a limited market for selling clothing — let alone designer handbags. The biggest threat to the industry could be "HENRYs" — a term luxury expert Pam Danziger coined, standing for "high earners not rich yet." These people make over $100,000, and, as she told Bloomberg, are "making very careful decisions" when it comes to spending. But because they're not picking up designer products, the luxury brands are feeling the burn. "Today, those people feel decidedly middle class and not at all luxury class," Danziger told Marketplace.org. Which begs the question — why buy luxury items? Especially when you can sweep your favorite items from the aughts on eBay for under $40. Then again, while some of Kate Spade's bags are relics of the past on the internet, its more fashion-forward bags are thriving — proving that the handbag industry can, in fact, save itself from an ominous fate. "In wholesale, our business was primarily driven by strong performance in handbags, with data showing a continuing increase in market share, representing a key opportunity for growth as we build on our still modest penetration of market share," CEO Craig Leavitt said on a recent earnings call for the company.  A Michael Kors store in Almaty, Kazakhstan. (Andrey Rudakov/Bloomberg) By Sarah Halzack A Michael Kors store in Almaty, Kazakhstan. (Andrey Rudakov/Bloomberg)If it seems like you see a Michael Kors purse on every shoulder when you walk down the street or hit the mall, there’s something to your observation: The brand had a years-long hot streak after going public in 2011 when its jet-set-inspired handbags and accessories became a must-have for aspirational luxury shoppers. But in the last year, investors and fashion insiders have begun to wonder if the brand was shooting itself in the foot by muscling into so many malls and by selling its bags for promotional prices that made them more accessible to the masses. Sales growth slowed dramatically, suggesting that as the brand became more ubiquitous, it was starting to lose some of the exclusive vibe that made it a hit in the first place. On Tuesday, Kors delivered an earnings report that sent a message to its doubters: There is, it seems, a path forward for the brand to thrive and recalibrate in the face of these perceptions. Kors said that comparable sales — a measure of sales at its stores open more than a year — were down 0.9 percent in most recent quarter. While that figure still pales in comparison to the blockbuster growth it posted two or three years ago, it is a clear improvement over what was seen in the previous three quarters. And the brand managed to notch improvement during a holiday season that was a tough one overall for the retail industry. Digging into the report more deeply offers some other reasons for optimism about the brand’s future. For one, the company said its average unit retail price was pressured this quarter, but it was pressured for the right reasons. On a conference call with investors, chief executive John D. Idol said the decline was not driven by having to resort to deep discounts to unload slow-selling merchandise, a tactic the brand has had to employ in the past. Instead, he said it was because shoppers are embracing the trend toward small-sized purses, crossbody bags and small wallets — pieces which logically come with a lower price tag than, say, a tote bag. So, overall, the company saw a strong increase in the number of items it sold in its core handbag business. That sends a message that Kors is figuring out how to score with something other than the $300 mid-sized handbags that have been its bread-and-butter (and which have also been crucial for rivals such as Coach and Kate Spade.) Kors has earlier stated that it is pulling back on its wholesale business of selling pieces in department stores in an effort to fight the perception that the brand is too omnipresent and thus lacks cachet. The improved results in its own retail outlets this quarter are, in a way, a validation of that strategic tack. While Kors has previously leaned heavily on department store sales — by one estimate, almost half of its sales come from such outlets — the momentum at its own stores and website offers hope that there is a viable iteration of this business that leans more heavily on direct-to-consumer selling. Investors sent Kors’s stock up a whopping 25 percent today, a sign that they were pleasantly surprised by the brand’s report. The company said revenue was up 6.3 percent to $1.4 billion in the quarter, and profit was $294 million, lower than the same quarter last year. The results come just days after a key rival, Coach, reported somewhat improved sales amid an ongoing struggle to polish the image of its overexposed brand. Taken together, the results at Kors and Coach suggest that these accessible luxury titans may be getting closer to putting their brands in the sweet spot between being overexposed and underutilized. Sarah Halzack is The Washington Post's national retail reporter. She has previously covered the local job market and the business of talent and hiring. She has also served as a Web producer for business and economic news. |

AuthorBagity.com for all your Fashion Accessories needs Archives

October 2017

Categories |

RSS Feed

RSS Feed